Digitalisation affects all parts of working life, including the power market.

Physical algorithmic trading: Quick decisions

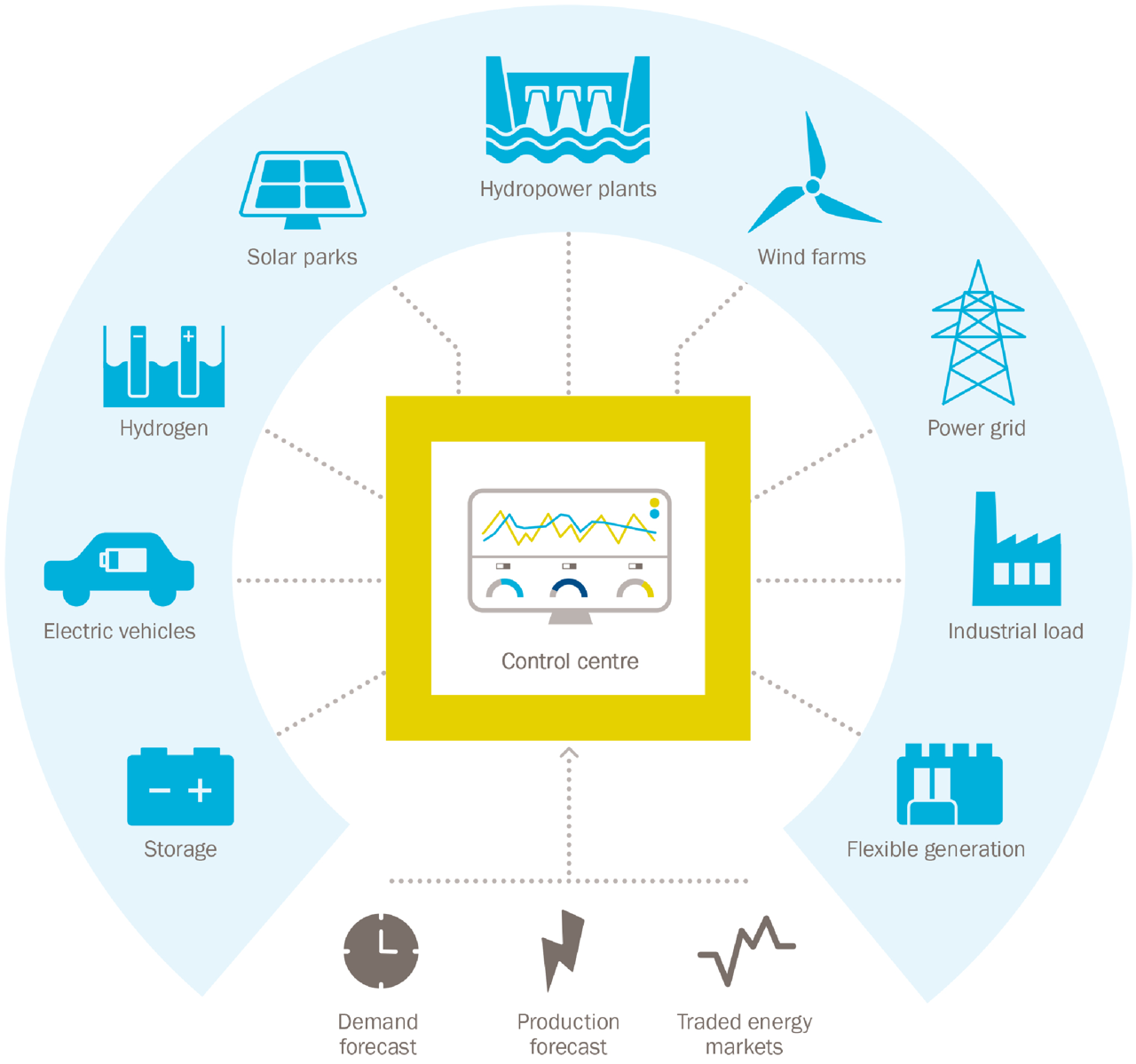

With an ever-increasing share of renewable energy sources in the power grid, digital solutions for energy trading have become indispensable. Based on carefully developed algorithms, traders can optimise power generation and power deliveries in real time.

Renewable power sources such as solar and wind have made the energy market more weather-dependent and thus more volatile, because changes in the weather affect power generation. This makes it more difficult to predict how much electricity must be generated at any given time by flexible technologies, e.g. hydropower, gas power or batteries to ensure an even power supply.

"By noon one day we may have sold power for different time periods the next day, for example based on expected wind production. But due to the fact that there are discrepancies between generation and consumption during the course of the day, this must be coordinated in real time between suppliers and consumers," explains Dr. Konstantin Wiegandt, head of Algorithmic Trading & Analysis at Statkraft's office in Dusseldorf, Germany.

Statkraft developed the first algorithmic applications in 2013, and has since developed a comprehensive portfolio of trading algorithms.

Through virtual power plants in Germany and UK, the fluctuating generation of renewable power from a number of small-scale producers can be consolidated and controlled.

"The closer we get to delivery, the better we can predict what type of power source can supply electricity and when, and we can trade the power right up to a few minutes before it is to be consumed. Since the time horizon is so short, we need support from our mathematical algorithms to make the right decisions," he says.

Refrigerator or electric car as power supply

No one can predict the coming weather with 100 per cent accuracy. Ten hours before a planned delivery of wind power, the uncertainty for wind production will be around 10 per cent, and the closer to delivery, the lower the uncertainty. A few minutes before delivery, it is about 2 per cent.

"Only at the moment of delivery do we know how much wind power is actually delivered. To ensure a stable power supply, wind or solar energy must be balanced with flexible power sources such as hydropower, batteries and gas power," says Wiegandt.

The trend in the market is moving towards a growing number of small-scale producers of flexible power.

"It's possible, for example, to go all the way down to a single electric car that can provide the power grid with flexibility while connected for charging. With the help of algorithmic trading solutions, we can integrate this type of small-scale flexibility into the power system. That is the path we must take to reach the goal of 100 per cent renewable energy," says Wiegandt.

Increased access to wind and solar energy is not enough in itself, since generation is so dependent on the weather.

"The electric car revolution is an example of a shift that can potentially create major opportunities to provide flexibility to the power grid. But this will require that thousands of wind turbines and solar panel systems be coordinated with millions of electric car batteries, and this can only be done through automation. Algorithms will play an indispensable role here," he says.

Units as small as a refrigerator could also be potential suppliers of flexibility, since their power consumption can be shifted in time.

"These are exciting times, because the power market and technology are interlinked in completely new ways," he adds.

Machines support people

In 2018 Statkraft acquired 61 per cent of the Munich-based company eeMobility, which supplies charging solutions for company car fleets.

"If we know that these electric cars are charging between eight o’clock in the evening and eight o’clock in the morning, we can calculate how much flexibility we can achieve from them. We'll only be seeing more of this type of flexible consumption," says Wiegandt.

Among other things, Statkraft manages trading with flexible energy resources on behalf of third-party producers in the United Kingdom in a fully automated manner.

"External data in the form of weather reports and information from customers and producers provide input for our systems, and then the algorithms calculate the best time to trade, produce or consume energy. Signals are then transmitted automatically to the power plants," he explains.

Statkraft's trading departments in Dusseldorf and Oslo are staffed around the clock every day. The robots do calculations, trade and plan, while the humans can intervene when necessary.

"Our power traders know how the algorithms work and can also develop or refine them. In the first half of 2020, Statkraft's algorithms completed three million transactions," says Wiegandt.

Statkraft's largest wind portfolio is in Germany, where algorithms are able to balance the entire portfolio of wind farms with a production of more than 10,000 MW.

"Employees can take over all or part of the transactions manually in particularly unstable situations, for example if a storm is forecasted. It's all about making quick decisions, and the machines support people in making the right choices. The faster and more efficient decisions we make, the cheaper it will be for consumers," says Wiegandt.

Konstantin Wiegandt

Dr. Konstantin Wiegandt heads the unit for physical algorithmic trading and analysis at Statkraft's office in Dusseldorf, Germany. The unit is part of the company's Markets business area.

See also: Financial algorithmic trading

In financial algorithmic trading, expectations of future trends in the energy market are bought and sold based on automated trading patterns. The interaction between machines and humans opens up completely new possibilities.